European Probiotic Market 2022: the market trend in a changing environment

In recent years, there has been a significant and undeniable shift in consumer preferences and

awareness regarding probiotics in Europe. Probiotics, which are live microorganisms believed to

provide health benefits when consumed, have gained substantial attention from the public due to increasing interest in overall health and well-being.

The European market of probiotic food and food supplements in 2022: The European probiotics market is on a growth trajectory. Among the European countries, the EU-5 countries stand out as the leading market for probiotics: Germany, France, the U.K., Italy and Spain. These countries together represent approximately 61% of the European market of probiotic supplements.

The fast-evolving European e-commerce: e-com growth in 2021 and 2022 for probiotic supplements is driven by Europe. The E-commerce market has definitely expanded in various dimensions. The track of the online salesin 2022 shows that about 48% of the products are from outside Europe labelled with probiotic claims. The EU consumer engagement online (expressed as product reviews) has grown between 100% and 200% per year. European consumers have become very engaged with pro/pre/post biotic products selling online, with reviews growing times 45 over 5 years (source Lumina intelligence).

Regulatory Framework and market access: with the increasing demand for probiotics and free market access for both domestic and international manufacturers, Member States are adapting the national rules to ensure that probiotic products in free circulation in the European market meet labelling standards and prevent misleading information to the consumers.

The updated European legal framework is available here.

One of the key facts is the rising demand for probiotic products across European countries. Consumers are now more health-conscious than ever before, and they actively seek out foods, supplements, and beverages that contain probiotics, recognizing their potential to improve digestive health, boost immunity, and even enhance mental well-being.

Download the consumer survey here.

The European Probiotic Market overview: Insights 2018-2021 for probiotic supplements, probiotic yogurt, and sour milk products

(Source: IPA data, elaborated on Euromonitor International data and Lumina International for on-online sales).

Background: After the end of the transition period for the entry into force of the Nutrition and Health Claim Regulation in 2009, the European market reported a significant loss in projected sales. During the same period, double digit growth in probiotic sales has been recorded elsewhere in the world.

Since 2018, the situation in the EU evolved. Some EU country issued national guidances and different interpretations were foreseen. More European countries started to be tolerant on the use of the term ‘probiotic’ in food and food supplements on label and in communication (with no reference to a specific health benefit). The positive market results in the EU reflect the increased use of the term ‘probiotic’ in several European countries.

This evolution whas been certainly influenced by consumer demand, but also by the increasing scientific data on the influence of diets and supplements in controlling and restoring the unbalanced gut microbiota, and the recognition that the microbiota plays a vital role in the sustainability of health and in the potential prevention of disease.

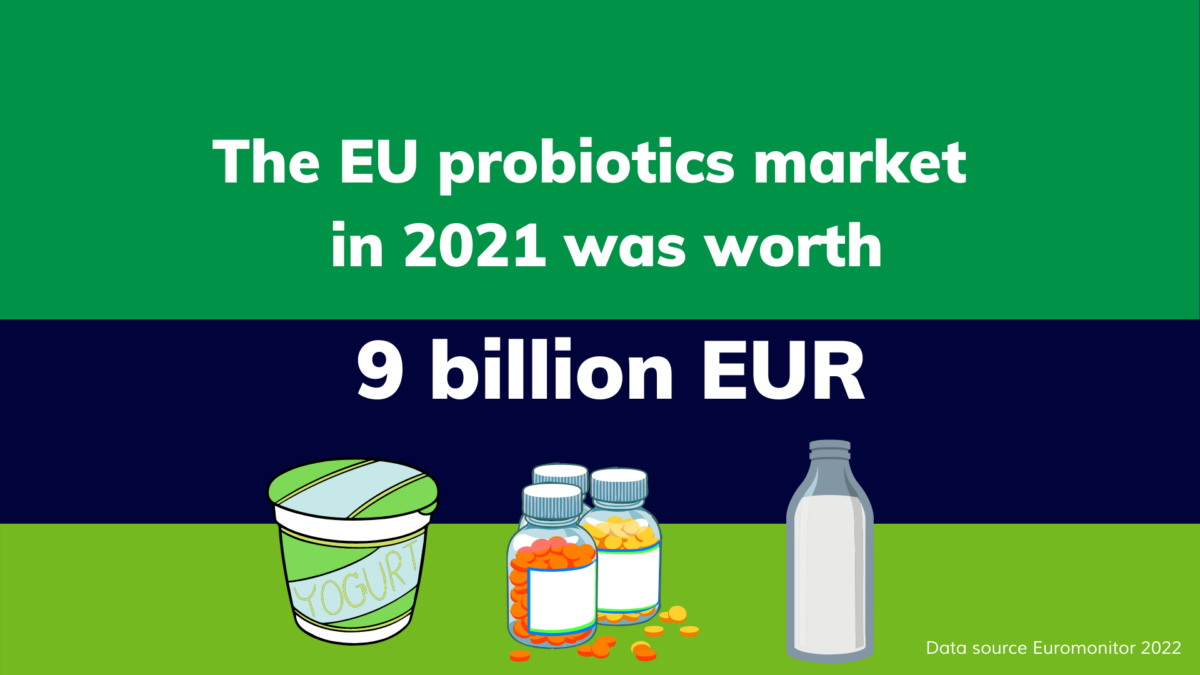

The European market in 2018 was 8.618,9 EUR million, reaching 9.401,6 EUR million in 2021. The growth rate of the European Market is 9,08% for the period 2018-2021.

Probiotic Supplements

The European probiotic supplements market was valued 1.464 EUR million in 2021, close to 25% of the global value, and with a forecast growth rate of 3% for the period 2021-2026.

Italy is the 3rd largest market in the world, with 560,5 EUR million of sales of probiotic supplements in 2021 and a forecast growth of 5% for the period 2021-2026. The market size in United Kingdom is also maintaining a good evolution, from 34 EUR million in 2018 it has reached 50,6 EUR million in 2021.

Italy Germany and France together have a market size of 775,6 EUR million, 64% of the EU sales, with positive expectations of growth.

In 2020, during the Covid19 crisis, the market experimented a shift to e-commerce sales, which continued in 2021. With the additional sales generated on e-commerces of 190 EUR million, Europe reaches in 2021 1.654 EUR Million.

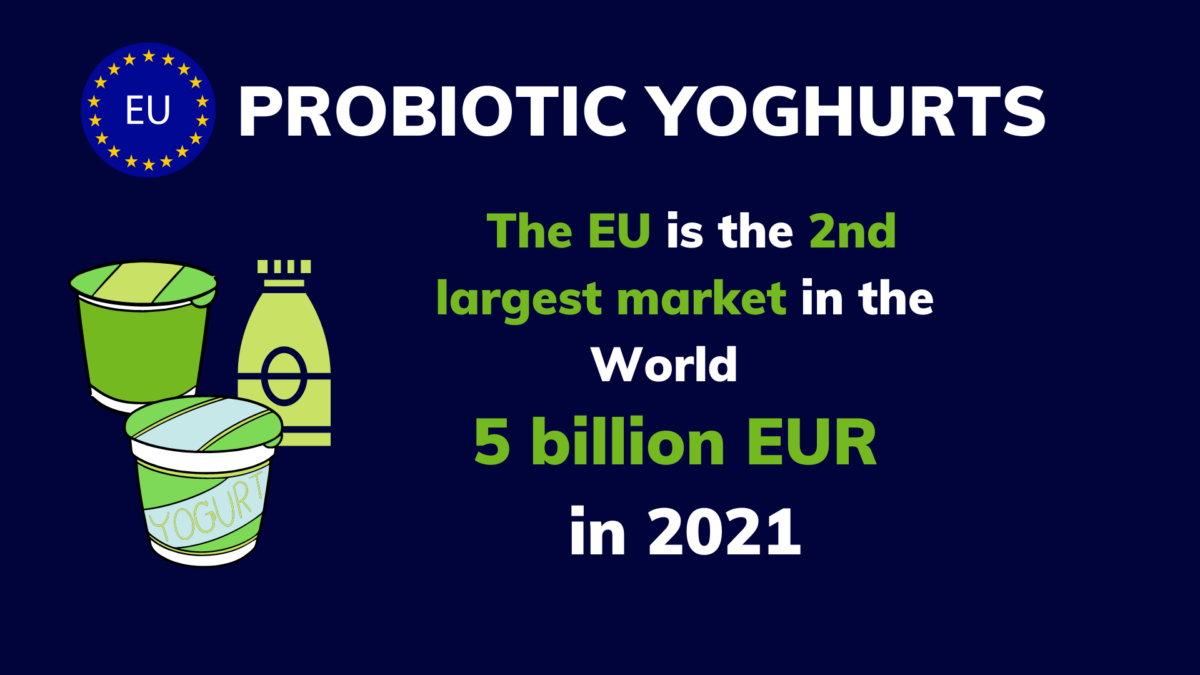

Probiotic Yoghurts, Plain, Flavored & Drinking Yoghurts

In the global scale, Europe ranks 2nd after Asia Pacific. The European market was valued 4.674 EUR million in 2018, and reached 5001,5 EUR million in 2021 (+7%). Eastern European countries are also showing a positive evolution from 897,9 EUR million in 2018 to 992 EUR million in 2021.

Among the European countries, UK is the first country in Western Europe with a value of 1.051,9 EUR million in 2021. Italy shows a constant growth from 425,3 EUR million in 2018 to 490,1 EUR million in 2021. This is also the case for Spain, from 643,9 EUR million in 2018 to 673,2 EUR million in 2021. Spain, Italy, Germany and France totalize 39,3% of the European market.

The Sour milk market is dynamic and shows a positive trend at European level

Europe is made of many well-developed sour milk product markets spread across the East and West. Globally, over 47% of sour milk products are consumed in this continent. The European pattern illustrates a steady increase from 2018 with 2.583,8 EUR million to 2.936,1 EUR million in 2021.